Thanks to Raymond’s analysis, I now have a healthy property portfolio and I am reaping the returns. Raymond’s insights on the property markets are unique and valuable. – Jun Hao, Senior Engineer

In the previous 2017 En-bloc cycle, some resale properties in En-bloc hotspots saw price gains of up to 28%. (We wrote articles about these moves in a previous article, you

One of the common questions we get is “when is the best time to upgrade my property?”, while there is no best time, there are signs that you should consider

Since 2018, we have been sharing with our clients and readers that resale properties are good options. Today, as of the date of writing, there are still a handful of

2020 has been an unprecedented year for many of us. While we are still in a recession, the stock markets have hit all-time highs, same for the local residential property

Don’t sell your home before you know what you intend to buy. The worst thing you can do is to sell your property and become stranded because you don’t know

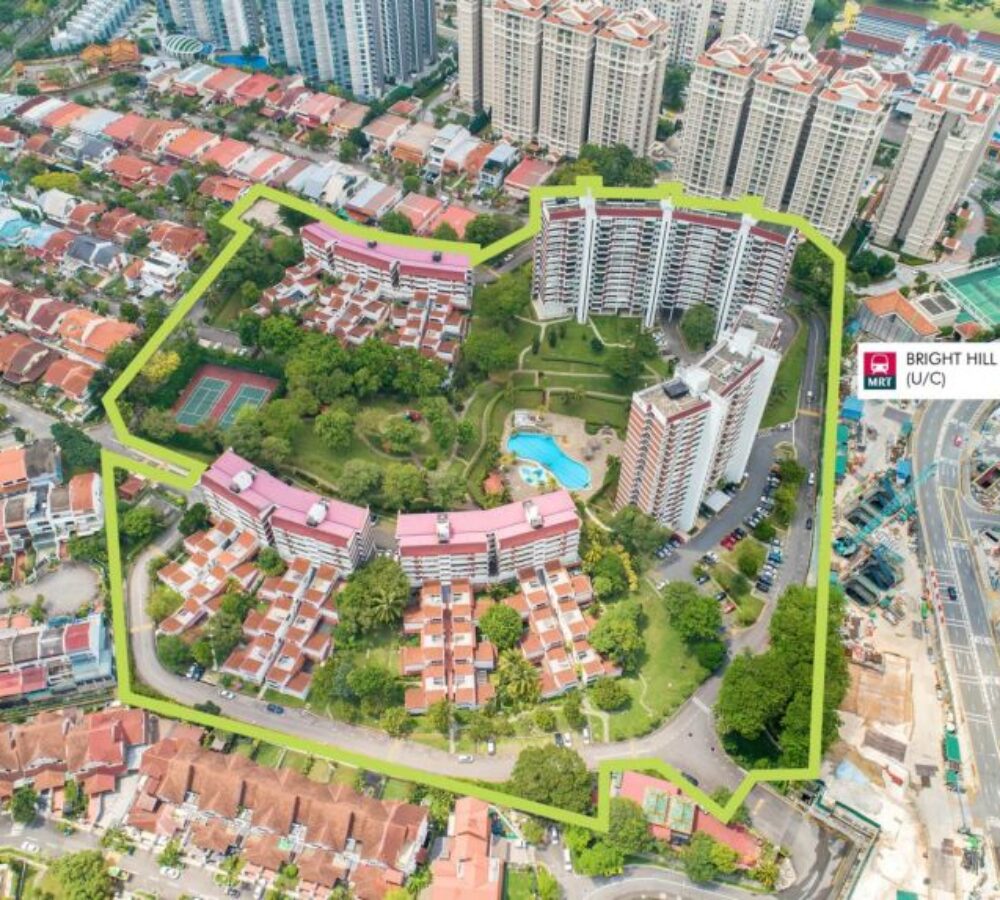

A look into Bidadari Estate’s Resale Condo – Part 3: Potong Pasir Cluster This is a 3-part series where we explore Bartley, Woodleigh and Potong Pasir Clusters to see if

A look into Bidadari Estate’s Resale Condo – Part 2: Woodleigh Cluster This is a 3-part series where we explore Bartley, Woodleigh and Potong Pasir Clusters to see if the

There is rarely a time where we think a new condominium is almost a perfect 10, we think we finally found the one. This is one for both visionary homeowners